In the dynamic landscape of Australian small businesses, ensuring your operations are protected from unforeseen risks is always on your radar. This is especially pertinent when dealing with contractors.

Having the appropriate insurance can mean the difference between smooth, sustainable operations and financial catastrophe.

Importance of Contractor Liability Insurance for Business Owners

When hiring contractors, ensure they have their own liability insurance, as your policies may not cover them. Include this requirement in your contract to protect both parties from accidents or damages. Public liability insurance covers property damage, personal injury, and legal costs, while professional indemnity insurance safeguards against claims related to their services.

Risks of Hiring Uninsured Contractors

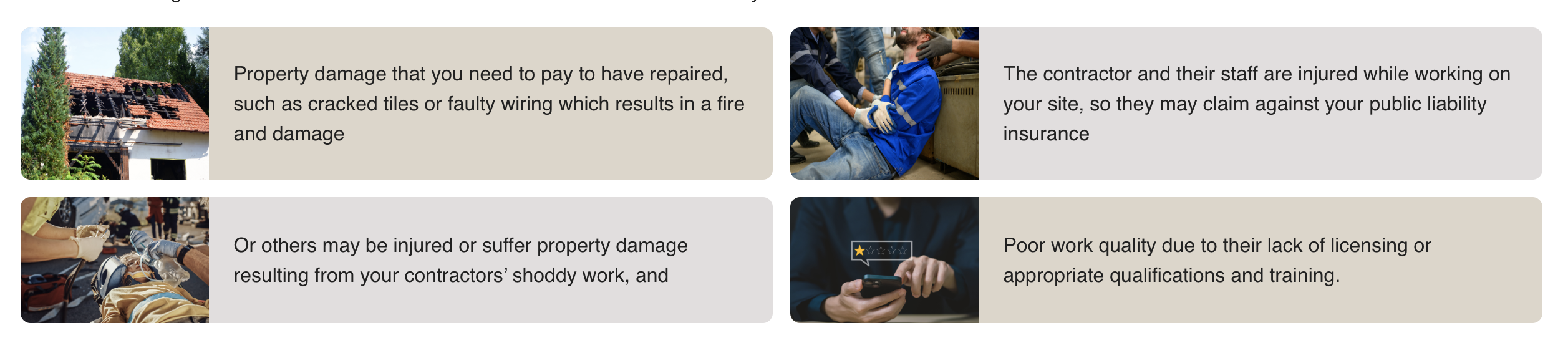

The risks of hiring uninsured contractors can be severe. Consider these issues they could cause:

Without proper insurance, your business is exposed to financial liabilities in case of accidents or property damage caused by the contractor’s actions. This could lead to potential litigation and legal consequences, impacting both your business reputation and financial stability.

Managing Risks as a Business Owner

To safeguard your business, take proactive steps to ensure that all contractors have appropriate insurance coverage.

- Make such cover a non-negotiable part of your hiring process

- Speak with their referees for peace of mind

- Evaluate their safety performance, workers’ compensation, and recorded injury rates

- Verify their qualifications where relevant

- See if they’re on the insolvency list of the Australian Securities and Investments Commission

And there are additional steps you can take too – click here for a comprehensive list.

Be mindful that if there’s a dispute over who’s liable, a court looks at the substance rather than the form of the relationship. Their examination may find there was a vulnerability or inequity of bargaining power between you and your contractor.

The Independent Contractors’ Act 2006 offers guidance on unfair contracts as this official government website explains. The Fair Work Ombudsman helps demystify the difference between independent contractors and employees. There are hefty fines for businesses claiming an employee is really a contractor – known as sham contracting.

Here are some examples of how Woolworths and Australia Post came unstuck with contractors.

Importance of Contractor Liability Insurance for Contractors

For contractors, having the right insurance is crucial for compliance and protecting their business. Public liability and professional indemnity insurance cover legal costs and damages. We can help you navigate policy details and ensure your coverage is up-to-date. Contractor liability insurance may be legally required and is essential for safeguarding assets and reputations, providing peace of mind in a volatile business environment.

If you would like to know more about Contractor Liability Insurance, please CLICK HERE, or contact us for more information.